We Provide

-

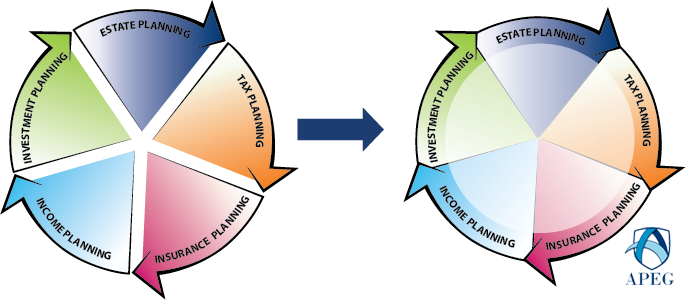

Customized and Comprehensive Investment Management

-

Retirement Income & Lifestyle Protection Strategies

-

Objective, independent advice

-

Education, collaboration and partnership

-

Peace of mind and clarity in decision making

-

Confidence all necessary areas are covered

-

Tax Planning

-

Hourly or Flat Fee Consulting/Planning

Lifestyle & Asset Protection

- Identifying and addressing risk factors to clients comprehensive plan, as well as the options and their best opportunities in each area

- Life Insurance: Multiple types of strategies and options, including Living Benefits

- Long Term Care Protection: Multiple product and benefit options. Typically a hybrid solution with benefits in multiple areas. We have a deep understanding of and access to many options, and our focus is on helping you and your family incorporate the right amount and type of protection in the most efficient way possible.

Life Insurance: Often Overlooked and Misunderstood

Access our “Decision Journey” to better understand what is relevant to you, whether you are young or old, if others depend on you, there may be a need for protection…

Long Term Care Protection Strategies: Benefits & Options

Access our “Comparing the Options – Benefits & Considerations…” Did you know there are more than 6 different strategies that we help clients with when it comes to addressing and protecting around Long Term Care!

Investment Management

- Analyzing your investment portfolio

- Creating the right asset allocation

- Minimizing investment risk ideally while maintaining attractive growth potential

- Financial market education/analysis

- Access to unique investment strategies including structured notes, both growth and income notes.

The Value of an Advisor: Clarifying roles values and expectations

Retirement Income Planning

- How to optimally withdraw from your retirement accounts based on your tax outlook and risk tolerance. Choosing which of the retirement income strategies are right for you.

- The appropriate level of risk with your assets as you transition from the working years to the distribution years

- Available income in retirement: Identifying, prioritizing and allocating retirement Income sources appropriately

- Social Security Benefit decisions, selecting the right pension option if that applies and planning ahead for required minimum distributions (RMD’s)

Tax Planning

- Awareness of your Tax picture in retirement: Factoring in multiple scenarios, including Social Security Benefits, RMD’s and future tax bracket changes

- Income tax planning: Taking advantage of annual tax planning opportunities, including Roth Conversions and reducing future taxable retirement assets without having to pay conversion taxes

Planning Your Estate & Legacy

- Identifying potential problem areas

- Maximize assets and minimize taxes for beneficiaries planning

- Introduction to or coordination with other estate planning professionals

- Life Insurance as an asset class: Review and advise around options and potential concerns with current policies